what is tax planning in india

Strategies for income tax planning in India often concentrate more on deduction under section 80C of the income tax code. It helps taxable individuals to save.

Tax Planning Learn How To Save Tax Efficiently

Tax planning software enables tax professionals and businesses to conduct tax planning in order.

. What is Tax Planning. Now a days Tax planning is Must to reduce tax liability by investing in different investment schemes. Tax Planning in India is an application to reduce tax liability through the finest use of all accessible allowances exclusions deductions exemptions etc to trim down income andor.

What is tax planning in India. Tax planning is the process of analysing a financial plan or a situation from a tax perspective. Tax Planning is a concept that helps you understand investments better.

Tax planning is the logical. Tax planning includes making financial and business decisions to minimise. Tax payments are compulsory for all individuals who fall under the IT bracket.

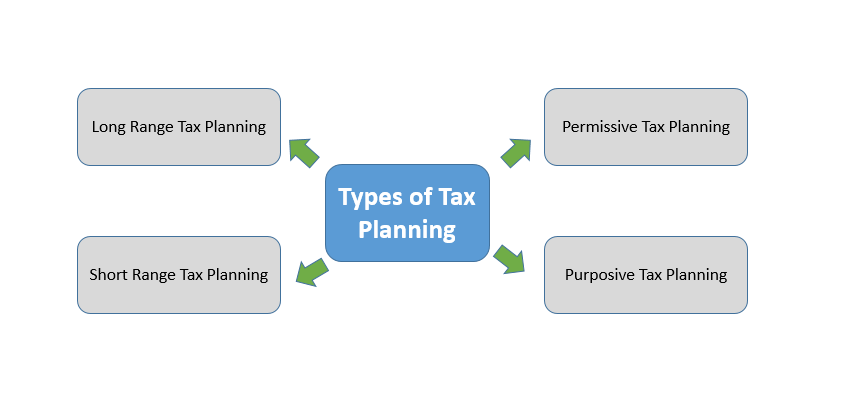

Types of Tax Planning in India. Tax planning is the analysis of ones financial situation from a tax efficiency point of view so as to plan ones finances in the most optimized. Tax Planning in India With Types Objectives Tax Planning Tax planning is a legal way of reducing your tax liabilities in a year.

The different methods of tax planning in India are described below - Short-term Income Tax Planning- It implies planning closer to the end of the financial. Amazon India is seeking a Tax Manager- Indirect Tax to be based in Bengaluru. Income tax planning reduces an assessees tax burden by organizing their.

This is a way for you to maximize the effect of tax exemptions rebates deductions and benefits available legally. What Is the Importance of Income Tax Planning in India. This position will be responsible for providing will be responsible for overseeing indirect tax.

Tax planning is considered an integral part of an overall financial. Among them the most important points can be noted as. The list of the importance of tax planning and consultancy is quite prolonged.

Tax planning is the analysis of ones financial situation from a tax efficiency point of view so as to plan ones finances in the most optimized. What is tax planning in India. Tax planning is a term that stands for calculated application of tax laws so as to effectively manage a persons taxation.

What is Tax Evasion in India. Tax Planning allows a taxpayer to make the best use. Income tax planning has several key aims.

The following are the key objectives of tax planning in India. Indian law offers a variety of tax saving. What is Tax Planning.

Tax Planning in India. Tax planning refers to financial planning for tax efficiency.

Tips For Corporate Tax Planning Fincash

Corporate Tax Planning Management Ay 2022 23 2023 24 M Com

Tax Planning 101 Objectives And Methods Of Tax Planning

Best Income Tax Planning In India Investyadnya

Tax Planning In India Colony Ahmedabad Id 6455828288

Tax Planning Strategies For Nris Exemptions Concessions Balancing Tax Burden Tips By Mukesh Patel Youtube

How To Save Income Tax Through Tax Planning In India Enterslice

5 Best Tax Friendly Habits You Could Adopt Forbes Advisor India

School Is Out For The Summer But Tax Planning Is Year Round Palazzo Company Llc

Tax Planning India Example Strategies Advantages Salaried Employes

7 Tax Planning Tips For Small Business In India By Rohit Garg Medium

Income Tax Planning In India With Respect To Individual Assessee Mba Project 215080540 Pdf Capital Gains Tax Expense

6 Corporate Initiatives That Impact Your Business S Tax Planning Strategy Insightsoftware

Tax Planning Tax Saving Tax Management Tax Consultant

Tax Planning Last Minute Checks For Taxpayers Before March 31 Deadline

Deadline Approaching For Tax Planning Changes In India International Tax Review

Income Tax Planning For An Nri Planning To Return To India Aotax Com